2017 was the first year when VR was a consumer reality. Headsets were available from a variety of vendors and at a variety of price points. Commercial markets for design and manufacturing began to adopt VR as a visualization too. And plenty of consumer VR experiences became available, from games to immersive video experiences, so nobody had an excuse for letting the device gather dust. First-gen VR experiences have wowed some users and disappointed others, but it’s clear that the technology will improve rapidly in terms of both the technical specs and the creative aesthetics. So where do we go from here?

Nowhere to Go But Up … Way Up

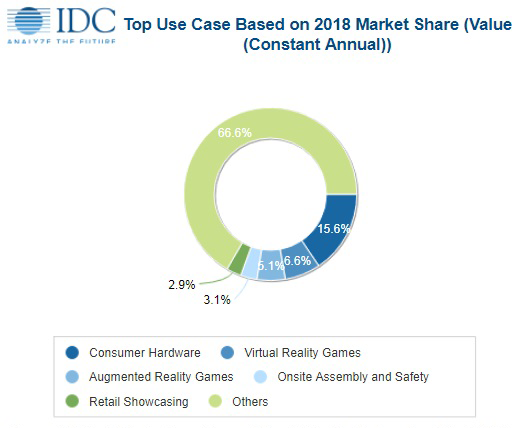

Most observers are expecting continued strong growth for VR in the foreseeable future. In its just-released Worldwide Semiannual Augmented and Virtual Reality Spending Guide, IDC projects AR/VR spending to climb by almost 95% in 2018, growing to a worldwide total of $17.8 billion from $9.1 billion in 2017. What’s more, the firm sees that robust annual growth rate holding steady through 2021. The fastest-growing segment of the market? The public sector — essentially infrastructure maintenance and government training — for which ICG expects a five-year compound annual growth rate of 156.7%.

Mind Commerce is a little less optimistic, projecting compound annual growth of just 54.84% from 2018 to 2023. That analyst pegs the single biggest VR market sector as education training, which it says should generate $2.2 billion in revenue by 2023. The company noted that commercial deployment of 5G mobile networks, currently scheduled to begin late next year, will be an important development. Their dramatically accelerated speeds will make high-bandwidth VR delivery available to untethered mobile devices.

Off the Leash

That last bit is key — wireless is about to become a must-have feature, with next-generation VR hardware benefiting from the increased sensation of freedom it provides. Analyst firm Canalys expects more than 1.5 million standalone VR headsets to ship in 2018. That means standalone headsets will be about one in four of the firm’s expected 7.6 million total VR headset shipments.

Oculus Go

Oculus

Presumably Sony’s tethered PlayStation VR will remain a dominant player in this space in the new year, having moved nearly 2 million units since the gaming device’s launch late in 2016. But Oculus is working on the $200 Go for launch early next year, and its more technologically advanced Project Santa Cruz is expected to be available as a development kit later in 2018, although no consumer release date has been suggested. And the cordless HTC Vive Focus is set for a January launch in China.

Mixed Reality Matters

As good as VR gets, it still has problems as a social application. If a group of friends are in the same room together, they tend to enjoy being able to see each other, rather than wearing a closed headset. And that makes AR, which allows users to see the real world around them along with digital augmentations, an interesting story in the near term. One of the technology leaders is Apple, which got on board with the ARKit included in iOS 11. With sophisticated AR-capable devices — that is, iPhones — already in the hands of millions of consumers, 2018 could become a crucial year for creators looking to make a splash with AR applications. If those experiences are compelling enough, AR will begin to shift focus away from VR.

And there’s always Microsoft’s HoloLens “mixed-reality” headset, a $3,000 AR device launched in 2015 that has gained a foothold in design and construction, education, and retail markets as well as in crime scene investigation, where Black Marble‘s app tuServe Scene of Crime helps police map a crime scene, including evidence, and archive the 3D space for later review.

Up, Down and All Around

Don’t forget about 360-degree video, which is also a potentially gripping VR experience, especially in stereo 3D. Even the watered-down version of 360 video available in web browsers that allow users to moving the field of view around their mouse can be compelling. Google ran an interesting test last year comparing viewer engagement with 360 videos vs. their traditional counterparts and found that 360-degree advertisements actually had lower comparative “view-through rates.” However, clickthroughs were higher on the 360 version, as were earned action metrics such as views, shares and subscribes, making the 360 video a better investment. It’s not clear if those trends hold up 18 months later, but it’s something to keep in mind.